The State of IT Outsourcing In Poland

from the

Comprehensive Hiring Guide for US Companies

Poland as a software development outsourcing destination - highlights

+400,000

of IT professionals available on the market

$12.4 billion

the estimated worth of the IT market in 2023

66%

of tech talent being employed by foreign capital

+130

Venture Capital companies operating on the market

IT Outsourcing and Offshoring in Poland

Poland — Key Facts

Size: 312,685 sq km, ranked 69th in the world by area (comparable to New Mexico)

Population: 38.18 million, ranked 37th in the world by population

Time zone: (GMT+2)

Government: parliamentary republic

Official languages: Polish

GDP per capita, PPP: $32,200 (2020 est.)

Human Development Index: 0.880 (ranked 35/189)

Currency: Polish złoty (PLN)

Economy: mixed economy, one of the fastest-growing economy in Europe

Main industries: agriculture, iron and steel, coal mining, automotive, shipbuilding, metallurgy, food production and processing, tourism

Major urban areas (over 500K people): Warsaw, Krakow, Lodz, Wroclaw, Poznan

Ease of doing business: ranked 40th, DB score - 76.4

Digital competitiveness index: #41 out of 64 | #38 Knowledge #41 Technology #39 Future readiness

Corruption perception index: 45/198

The WE Forum Global Competitiveness Report: #37, with a year to ear improvement in score

A.T. Kearney Global Services Location Index: 24th

Universities: 500 universities, nineteen listed by QS World University Rankings® 2022 (two ranked 308 and 309, the rest >500)

The largest IT companies: Asseco, Comarch, Integrated Solutions, NTT System, Ericpol, CD Projekt, Sygnity, Transition Technologies, J-Labs

IT industry market share: 8% of GDP, 2.7% share in employment, 60,000 IT companies, ca. 430,000 IT specialists - incl. 250,000 programmers

EF English Proficiency Index: 16/112 countries, 14th out of 35 European countries

International Olympiad in Informatics: 119 medals, 41 gold, 46 silver, 32 bronze

IT outsourcing in Poland at a glance

Poland's central location on the European map makes it a strategic gateway between East and West, always within easy reach. The country serves as a role model for successful transformation, evolving from a communist state into one of Europe's largest economies in the span of merely three decades. Since joining the EU in 2004, it has experienced unprecedented economic growth, becoming the first former Soviet bloc country to reach a developed market.

The Polish software development services market is also thriving, representing about 8% of the country’s GDP. Poland has the largest IT specialists pool in the entire Central & East Europe. Its broad ecosystem of innovative startups, entrepreneurs, and enterprises, combined with robust digital infrastructure, encouraged numerous global corporations to move their operations to Warsaw, Krakow, Katowice, Wroclaw, and other outsourcing hubs.

The Polish IT sector orientates strongly towards international projects. 34% of half a million IT experts work for companies with the Polish capital, while foreign organizations employ the remaining 66%. IT services account for one-third of all Polish services exports to the USA.

These numbers shouldn't be surprising considering the high profitability of foreign investments. According to a joint report by KPMG and the American Chamber of Commerce, "every dollar invested in Poland by American companies creates 50% more value than other foreign investments."

The interest of multinational tech corporations in the Polish IT market is evident. And it is easy to account for. Poland consistently ranks as one of the top three countries with the world's best programmers. Polish software developers top the charts in Java development and score second to fifth in Python, Ruby, Shell, and algorithms (source: HackerRank). Significantly, a recent report by Google and Dealroom found that Poland has the most startup ‘unicorns’ in the region.

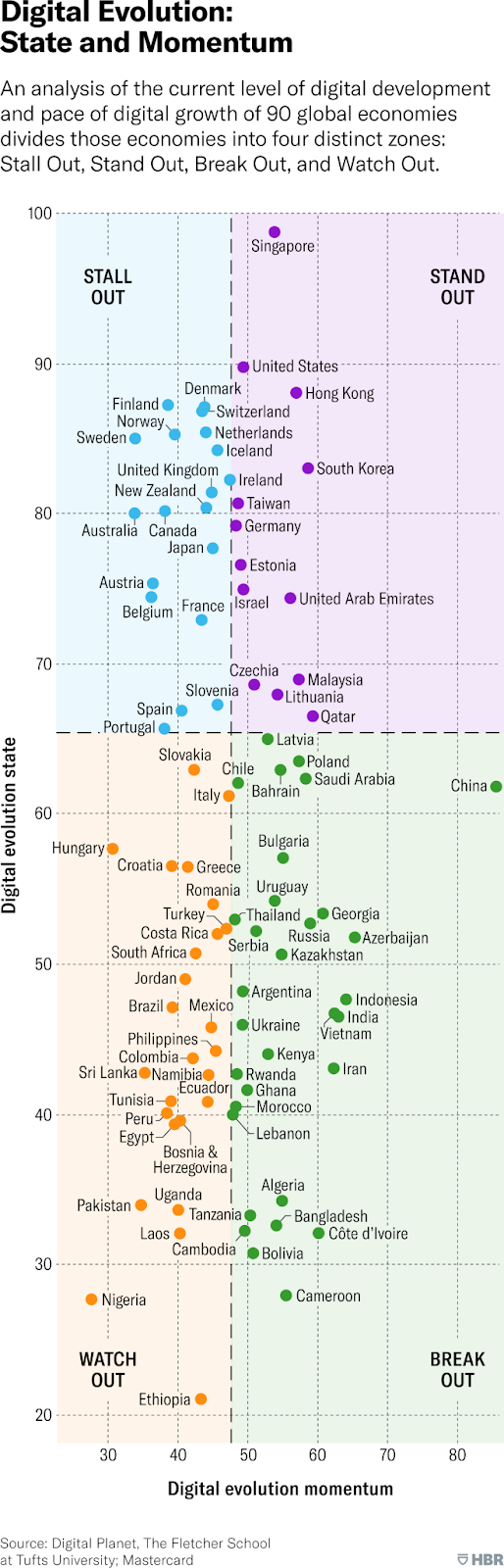

If we look at the 2017 Digital Evolution Index (the latest available), we can see Poland among digital innovation leaders. The Polish IT market is currently estimated at $12.87 billion, an increase of more than 7% compared to 2020. The category includes the segments of IT equipment, software, and IT services.

The most sought after software languages on the Polish market include Javascript (28%), Java (20%), Python (16%), TypeScript (8%), PHP (8%), and C# (7%), followed by Kotlin, Swift, Scala, and Ruby (Statista).

Labor cost is likely the main concern for companies considering hiring offshore software developers from Poland. With quality comes the price. And obtaining services in a country that offers the largest and most diverse talent pool, the most reliable infrastructure, adherence to EU standards in IP protection and data security, and the greatest ease and transparency of doing business, cannot be cheap.

According to the 2021 report by the Sedlak & Sedlak consultancy, Java Junior Software Developers in Poland earn between $1,000-$2,000 per month, depending on their skills, location, and type of contract. Mid-level experts get between $1,900-$2,680 per month, while expert programmers earn $3,800 per month on average (with top pays exceeding $4,300/month).

Looking at other IT senior positions, we’ll learn that support specialists get about $1,800 per month on average, data analysts earn from $2,000-$3,300/month, while seasoned frontend programmers’ pay ranges between $2,900 and $3,700 monthly.

Compared to salaries in Ukraine or Belarus, the rates charged by Polish specialists remain in the top tier. Nearly half of them get paid at least $2,000 a month, with over 13% earning twice that amount. Meanwhile, 40% of IT professionals in Ukraine only get about $1,000 per month (Source: NoFluff Jobs).

Still, Polish IT experts are very much in demand. So, what’s the conclusion? They clearly compete on expert skills, impeccable work ethic, service reliability, and ease of communication, rather than low rates.

Investing in the Polish IT market

Broadly recognized for modern IT infrastructure, high economic potential, and a well-educated, highly-qualified workforce, Poland is currently the European leader in terms of the size of foreign direct investment, with the IT and tech market largely contributing to its success.

The subsequent years indicate an apparent shift away from outsourcing basic, low-skill installation and support IT tasks to the Polish workforce in favor of delegating entire projects and services to Poland-based outsourced teams. This trend also shows in some of the most recent (and noteworthy) examples of global IT and tech investments.

Major foreign investors

The largest international IT companies operating in the country (by revenue) include Dell EMC, HP Inc, Lenovo, Microsoft, and IBM Polska, followed by other prominent names such as Intel, Apple, Cisco, Oracle, Xerox, Sabre, or Google.

- January 2019 – Uber expanded its operations in Krakow, Poland, to add $3 million to its initial $10.5 million investment in the Polish center of excellence.

- November 2019 – Amazon opened two massive fulfillment centers in Poland, equipped with AI technology. Together, they created over 1,000 new jobs in the roles, including software engineers, IT specialists, and operations managers. Additionally, in 2021, the company launched its Polish store, amazon.pl, with hopes to snatch market share from a home-grown rival, Allegro.

- May 2020 – WordPress confirmed the plans to open a global innovation hub for its WP Engine in Krakow as a part of its international expansion.

- May 2020 – Microsoft announced an enormous investment of $1 billion to speed up innovation in the "Polish Digital Valley." The plan envisages opening a new datacenter region in Poland to provide the local companies and government with access to secure cloud-based services.

- June 2020 – Google followed, confirming even a more impressive investment of $2 billion in its Polish datacenter.

- September 2021 - PricewaterhouseCoopers announced it would invest over $100 million to expand its Polish office. The company is looking to hire 5,000 specialists in cloud and automation.

Incentives to invest

Before 2018, Special Economic Zones (SEZ) were operating in Poland, offering various tax exemptions to attract foreign investors. The 2018 amendment to the fiscal law replaced SEZs, turning the entire country into a special economic zone and making tax incentives available across Poland's territory on publicly and privately owned land.

The new regulations mean that the availability of tax reliefs no longer depends on the location, but it's calculated based on a variety of factors that include:

- The costs of the investment.

- The size of the enterprise.

- The permissible level of the state aid per region.

The period of tax exemption varies from 10-15 years across regions.

Additionally, the Polish regulations provide tax deductions for R&D activities, the scope of which is contingent on the company size and the type of eligible costs. These may fall into one of six categories, including employees' wages and social contributions, expertise, research and insights from scientific units, the costs of obtaining IP protection, etc.

Apart from these incentives, in 2019, the Polish government established the Innovation Box scheme. It applies a preferential, 5% tax rate applicable to income derived from IP rights (i.e., among others, author's rights to a computer program or a patent).

→ More details about Poland's broad range of investment incentives can be found on the Polish Investment & Trade Agency's website and in PWC's Worldwide Tax Summaries.

Higher education in Poland

Poland boasts over 400 higher education institutions, including over 40 state-owned universities and nearly 20 public Institutes of Technology (Politechnika).

- The number of students exceeds 1.2 million, i.e., every 30th Pole is currently studying.

- Just as in Belarus's case, the literacy rate in Poland is among the world's highest.

- Similarly, public higher education is free, with a range of university scholarships and grants available.

- The first study cycle comprises three or four years, and upon its completion, the graduate is conferred the Bachelor's Degree (either in Arts or Science). A Master's degree program typically lasts 1.5 to 2 years. Certain fields of studies such as Law, Medicine, Psychology, Acting, or Canon law, offer long-cycle programs, lasting up to 6 years.

- Information technology has been consistently the most popular field of study in the last few years (over 33,000 applicants in 2020), followed by psychology, medicine, and management.

- The history of higher education institutions in the country goes back to the Middle Ages. The Jagiellonian University in Krakow, the first Polish HE institution, was set up as early as 1364, earlier than the University of Vienna, University of Glasgow, or Munich. The oldest technical HE institution in continuous operation is The Warsaw University of Technology, established in 1826.

- Nineteen Polish HE institutions are included on the QS World University Rankings® 2022 list, with Warsaw University and Jagiellonian University taking 308th and 309th positions, respectively.

- Poland has become one of the most popular higher education destinations for international students in Europe in recent years. In 2020, over 85,000 foreigners were studying in Poland, and the number is steadily growing.

- The tuition fees for international students are higher than in other countries in the Central & East Europe region, ranging from $2,200 up to $6,700 per year, depending on the institution, faculty, and study program. However, EU/EEA students are not required to pay tuition fees for the courses taught in Polish.

- The majority of leading institutions offer courses in English.

Poland's startup ecosystem

In the last few years, Poland has joined the most startup-friendly countries in Europe and beyond.

The Polish startup ecosystem ranks 30th in the Global Startup Ecosystem Index 2021 (much higher than Romania – 41st, Hungary - 49th, Belarus – 67th, and above Ukraine – 34th). The capital city, Warsaw, took the 78th spot in the cities’ ranking. Several other cities such as Gdansk, Krakow, and Wroclaw can also boast a remarkable concentration of coworking spaces, accelerators, and incubators.

In 2019, the VC funding for Polish startups increased by 800% compared to the previous year. By mid-2020, the investments in the VC market reached a level equal to that of the entire 2019. Going further, in the first half of 2021, Polish startups acquired over $243 million from investors - more than 55% of the value of investments throughout 2020.

This vigorous growth dynamics of the Polish startup scene has been further confirmed by Poland’s status as the country with the largest number of startups classified as unicorns in Central & East Europe (data from 2021).

Key startup cities

Warsaw, Wroclaw, Krakow, Gdansk, Poznan

Startup ecosystem in numbers

- +3,000 startups

- 10 unicorns (the most in the Central & East Europe region)

- +130 VC firms (with Smok Ventures, Market One Capital, Innovation NEST, Giza Polish Ventures, Innovation Nest, and Next Road Ventures leading the way)

- +100 incubators and accelerators

- +100 coworking places in Warsaw alone

- + 255,000 software developers

Focus industries

Fintech, food tech, AI and RPA, data analytics, SaaS platforms

Success stories

- DocPlanner – the leading healthcare booking platform, founded in 2011 in Warsaw. After accumulating $140.5 million in seven funding rounds, today, it's valued between $300-500 million.

-

Brainly – another massively popular software platform from Poland, Brainly, is the world's largest peer-to-peer learning community. Set up in Krakow in 2009, and valued at $100-200 million, it is now available in nearly 40 countries.

- Booksy – now based in San Francisco, Booksy is a Poland-based booking application for the beauty business. It secured $92.2 million of funding across seven rounds from several international investors. Currently, the platform processes over 3.5 million bookings per month, and it's valued at $100-200 million.

- Kontakt.io – this Polish startup set up in Krakow is a leading vendor of smart beacons, gateways, and other IoT devices. The volume of VC funding obtained in five rounds is much more modest than in other top Polish startups ($8.3 million). Still, the company delivers some of the most innovative solutions in the indoor navigation space.

- Synerise – another startup from Krakow, Synerise, was set up in 2013 to provide clients with data analytics and AI solutions. Since its foundation, the company has raised $19.2 million over nine rounds, achieving the valuation of $85 million and tripling its customer portfolio in 2018.

-

SALESmanago – this Krakow-based company offers an AI-based marketing automation platform, competing in over 40 countries with HubSpot, Marketo, or GetResponse. The startup collected $7.7 million over four funding rounds.

-

Ten Square Games - a mobile game developer, with headquarters in Wroclaw. In 2018, the company went public, with shares trading at the Warsaw Stock Exchange. Last year, it saw net revenues of $153 million, a CAGR of 140% year-to-year.

Challenges

-

Limited Foreign Investment: Poland faces challenges in attracting foreign investors, with a relatively low share of foreign investors accounting for approximately 4% of the market. This presents an opportunity for companies seeking to tap into the potential of Poland's market.

-

Leadership and Management Gap: One of the challenges in Poland is the gap in leadership and business management experience. Companies operating in the country may need to focus on developing local talent and investing in leadership development programs to bridge this gap.

-

Limited Global Connections: Poland's market has historically been inward-oriented, resulting in deficient global connections. To overcome this challenge, businesses can explore strategies to enhance international collaborations, foster networking opportunities, and expand their reach beyond domestic borders.

Pros of software development outsourcing in Poland

- Over 400,000 IT professionals available on the market

- Easy access to a versatile set of skills matching specific sectors or projects

- Robust AI and data science ecosystem to support state-of-the-art technologies

- IT services are one of the pillars of the robust Polish economy

- A shared legislative and regulatory framework (EU membership)

- The highest English proficiency competencies out of all Central & East Europe countries

- Ranked among the world’s top 5 countries for software skills

- Considerable foreign investment, especially in the IT/tech sector

- Ranks high on the ease of doing business and competitiveness

- Maintains the lowest level of corruption in business among Central & East Europe countries

- Ease of travel: central location; Ryanair hub, Schengen zone

Cons of software development outsourcing in Poland

- Fierce competition may lead to high turnover in projects

- Potentially higher salaries as compared to other Central & East Europe countries

In 2023, Poland continues to establish itself as a prominent destination for IT outsourcing. With a highly skilled workforce, competitive costs, and a favorable business environment, Poland offers compelling advantages for companies looking to outsource their IT needs.

The country's IT outsourcing industry has witnessed steady growth, attracting both domestic and international clients. Poland's robust educational system produces a talented pool of IT professionals, including software developers, engineers, and IT specialists, who are well-versed in the latest technologies and programming languages.

Poland's IT outsourcing sector benefits from a solid infrastructure and advanced technological capabilities. The country boasts modern technology parks, incubators, and innovation centers that foster collaboration and enable the development of cutting-edge solutions. Additionally, Poland's favorable time zone overlap with major European and North American markets allows for efficient communication and project coordination.

In terms of cost-effectiveness, Poland offers competitive pricing compared to Western European countries and the United States, making it an attractive option for cost-conscious businesses seeking high-quality IT services.

Moreover, Poland's IT outsourcing providers are known for their professionalism, reliability, and commitment to delivering exceptional results. Many companies in Poland have achieved globally recognized certifications and adhere to international quality standards, ensuring the highest level of service and security.

As companies increasingly recognize the benefits of IT outsourcing in Poland, the industry is expected to continue flourishing in 2023. Businesses seeking skilled IT professionals, access to cutting-edge technologies, and cost-effective solutions should consider Poland as a top destination for their IT outsourcing needs.

.png)

Seeking more insights about hiring IT talent from Central and Eastern Europe?

Read the full version of our Tapping into Central and Eastern European Talent: A Comprehensive Hiring Guide for US Companies

Get the full guide

Get your free copy of the guide now.

Unlock the secrets to successfully hiring IT talent from Central and Eastern Europe: navigating visa requirements, understanding tax implications, tackling legal considerations, protecting intellectual property, and making smart financial decisions.

IT outsourcing... reinvented!

Why work with Polish developers?

Best devs in the world

Central & East European countries are world-renowned for their software developers who are said to be one of the best on the globe.

Huge talent pool

There are over 1 million software developers in Central & East Europe, skilled in various technologies and experienced in every industry.

Competitive rates

Software developers' hiring rates in Central & East Europe can be 2-3x lower when compared to the US and Western Europe.

Cultural proximity

Great English skills and vast experience in working on international projects. Central & East European devs have been supporting startups worldwide for years now.

Looking for a trusted IT outsourcing partner? Hear from our partners and clients.

Ideamotive has a huge pool of talent. Don’t just settle for someone: find a person who understands your project and has the competencies you need.

Julian Peterson

President, Luminate Enterprises

We’ve been extremely satisfied. We work with multiple partners, but they’re our main supplier because of the quality of their work.

Håkon Årøen

Co-founder & CTO of Memcare

They understand and navigate the industry to deliver an outcome that will truly stand out. Despite a heavily saturated market, they’ve delivered creative solutions that I haven’t seen before.

Adam Casole-Buchanan

President, Rierra INC

They are very flexible, providing a team of developers on short notice and scaling the size as needed. Their team meets tight deadlines, including some that only give them a few hours to do the work.

Sylvain Bernard

Event Manager, Swiss Federal Institute of Technology Lausanne

Considering hiring tech talent from Central & East Europe?

Ideamotive is a tech talent marketplace providing on-demand IT experts matched with client's technology, industry, and company culture.

Rated 4.8 / 5.0 by clients from various industries and locations.